Top 10 Wrapping Paper Manufacturers and Suppliers in China

- Leo Xia

- Dec 9, 2025

- 15 min read

If you’re trying to shortlist Top 10 Wrapping Paper Manufacturers in China, you’re probably looking for three things: stable quality, sustainable materials, and suppliers who actually understand export timelines.

This guide pulls those threads together. It combines market data, official standards, and factory-level certifications so your team can quickly answer:

Who are the leading wrapping paper manufacturers in China?

Which one fits my brand, volume, and budget?

How do I safely import and control quality from overseas?

Quick Content Reach:

Quick Summary: Best Wrapping Paper Manufacturers in China at a Glance

Here’s a fast overview of the Top 10 Wrapping Paper Manufacturers in China for wholesale and custom projects

Lion Paper Products – One‑stop paper Stationery& Gift products manufacturer and supplier with China + overseas factories (Cambodia).

TN Wrap Paper – Mid‑sized supplier known mainly via B2B platforms; good for buyers comfortable working with trading-style manufacturers.

PackingOne – Specialized in printed and premium wrapping paper with strong focus on export orders.

Best 4U – Flexible ODM/OEM partner for customized gift wrap and related paper goods (information mostly from trade directories).

Xiamen Blue City Print Co., Ltd. – Long‑established paper craft printer (since 1995) with ISO and G7 color‑management credentials.

JUDI Packaging (Dongguan Judi Industrial Co., Ltd.) – Eco‑focused custom paper packaging specialist, including tissue and gift wrap.

Jialan Packaging Products (Yiwu Jialan Package Co., Ltd.) – Yiwu‑based packaging factory covering gift bags, boxes, and wrapping paper.

MyStyle Ribbon (Xiamen Meisida Decoration Co., Ltd.) – Ribbon + gift wrap specialist with two factories and FSC‑linked materials.

Mikirei – Design‑driven stationery and gift‑packing maker supplying gift wrap to over 100 countries.

Xincan Packaging Products (Yiwu Xincan Packaging Products Co., Ltd.) – Newer player (est. 2018) focused on wrapping paper and holiday packaging.

Comparison Table: Top 10 Wrapping Paper Manufacturers in China

Using public information from company sites and major B2B listings; always confirm details directly before placing orders.

# | Manufacturer | Main Location(s) | Key Products | Stand‑out Strengths | Best For |

1 | Lion Paper Products | Jiaxing factories in Cambodia | Gift wrap, custom notebook, gift bags, stationery | One‑stop, multi‑country production, strong export track record | Large retailers, brands stores, seasonal programs |

2 | TN Wrap Paper | China (mainly seen on B2B platforms) | Kraft & printed wrap, food‑adjacent paper | Flexible small to mid‑sized orders, competitive pricing | Importers comfortable vetting newer suppliers |

3 | PackingOne | China | Printed & premium wrapping paper | Focus on gift wrapping, wide print processes | Distributors & mid‑size brands needing diverse designs |

4 | Best 4U | China | Gift wrap, gift bags, paper sets | ODM/OEM branding, custom artwork | Private‑label brands & supermarkets |

5 | Xiamen Blue City Print | Xiamen | Scrapbook paper, pads, stickers, wrapping papers | Since 1995, ISO & G7‑driven color control | Brands needing tight color consistency |

6 | JUDI Packaging | Dongguan | Tissue, gift wrap, boxes, bags | Eco‑friendly focus, full custom packaging | Fashion, lifestyle & premium brands |

7 | Jialan Packaging Products | Yiwu | Gift bags, boxes, wrapping paper | Yiwu sourcing hub, large design library | Small to mid‑size retailers & e‑commerce |

8 | MyStyle Ribbon | Xiamen & Vietnam (paper/ribbon) | Ribbons, gift wrap, paper crafts | Ribbon + wrap sets, FSC‑linked products | Brands wanting coordinated ribbon + wrap |

9 | Mikirei | Yiwu & global agents | Gift wrap, gift bags, boxes, cards | Strong original design, 3,000+ new designs/year | Design‑driven brands & chain retailers |

10 | Xincan Packaging Products | Yiwu | Wrapping paper, gift boxes, holiday products | Focused on seasonal & Christmas ranges | Seasonal importers & decor brands |

How to Use This List

If you’re a big retailer or global brand: Start with Lion Paper Products, Mikirei, Blue City Print, and JUDI for higher capacity, certifications, and design support.

If you’re a smaller brand or Amazon seller: Look at Jialan, Xincan, MyStyle Ribbon, and PackingOne for flexible MOQs and customized designs.

If you prioritize sustainability: Shortlist suppliers with FSC‑linked materials, recycled papers, and verified social audits (see sections on FSC and BSCI below). Management Systems World+4Forest Stewardship Council+4anz.fsc.org+4

China Wrapping Paper Market Snapshot

Global & China Market Size and Growth

While gift wrapping paper is a niche inside the wider packaging industry, it’s growing faster than many traditional paper segments:

One global study estimates the gift wrapping paper market at around USD 18.36 billion in 2023, with a CAGR of about 6.3% toward 2030. Global Info Research

Another report on gift wrapping products (including bags, ribbons, tags) values the market at around USD 19–20 billion in 2023, potentially more than doubling by 2033 at over 8% CAGR. Grand View Research

The paper & paperboard packaging segment overall is huge—various studies put it in the USD 330–380+ billion range in 2024, with annual growth of roughly 4–5%. Towards Packaging

China plays an outsized role in this:

China is one of the largest exporters of gift packaging, paper bags, and wrapping paper, with hubs like Yiwu acting as sourcing bases for global buyers. china-buying-support.

These figures tell you one thing: wrapping paper is a serious, high‑growth niche, not just a seasonal add‑on.

Common Wrapping Paper Materials and Finishes

In China, most factories will offer combinations of:

White or brown kraft paper

Coated art paper (usually 80–120 gsm for gift wrap)

Tissue paper

Foil and metallized papers

Increasingly, recycled or FSC‑certified stocks anz.fsc.org+3Forest Stewardship Council+3anz.fsc.org+3

Typical finishes include:

Matte or gloss varnish

Hot foil stamping

Embossing/debossing

Spot UV

Glitter (including newer biodegradable options)

When you brief suppliers, always specify:

GSM (paper thickness)

Opacity

Finish type

Print method (offset, flexo, digital)

Sustainability & Certifications Buyers Should Know

If you want your products to be future‑proof, three logos/terms come up again and again:

FSC® (Forest Stewardship Council)

FSC chain‑of‑custody certification shows that your paper is sourced from responsibly managed forests and controlled sources. Forest Stewardship Council

amfori BSCI (Business Social Compliance Initiative)

A global system that helps brands monitor and improve working conditions in supply chains, aligned with key international labor standards. Management Systems World

ISO 9001 & Print‑related Certifications (e.g., G7)

ISO 9001 is the best‑known standard for quality management systems worldwide, used heavily in manufacturing and packaging. ISO+1

G7® is a color‑management methodology that helps ensure consistent color across print runs and substrates, widely adopted in the printing industry.

When you ask suppliers for credentials, get up‑to‑date certificates (PDF or registration number) rather than relying only on catalog claims.

How to Choose the Right Wrapping Paper Manufacturer in China (Step‑by‑Step)

Think of this as a simple 7‑step sourcing checklist.

Step 1 – Clarify Your Use Case and Volume

Write down:

Who are your end customers? (luxury, mass retail, e‑commerce, florist, etc.)

Where will the wrapping paper be used? (in‑store gift wrap, pre‑packed products, online orders)

Annual volume: how many rolls, sheets, or packs do you realistically need?

This helps you match:

Large factories (Artcool, Mikirei, JUDI) for higher volume and complex programs

Medium players (Jialan, Xincan, MyStyle Ribbon) for mid‑range or seasonal orders

Step 2 – Decide on Material, GSM and Finish

Create a brief that includes:

Material: kraft / art paper / tissue / foil / recycled

GSM range:

17–22 gsm → tissue

60–80 gsm → light gift wrap

90–120 gsm → premium wrap / bags

Finish: matte, gloss, foil, embossing, glitter

Printing: CMYK vs Pantone spot colors; coverage percentage

Share photos or PDFs of references to reduce miscommunication.

Step 3 – Check Printing & Customization Capabilities

Ask suppliers:

What max print width can you handle?

Which print methods (offset, flexo, digital) are available?

Can you match Pantone colors and provide digital + physical proofs?

Any special effects: foil, glitter, holographic, soft‑touch, etc.?

For brands with strict colors (e.g., cosmetics or premium retailers), working with G7‑capable printers like Xiamen Blue City Print can help keep your designs consistent across seasons and reorders.

Step 4 – Verify Quality & Sustainability Standards

Key checks:

Quality management: ISO 9001 or equivalent QMS

Print consistency: G7 or similar color‑management practices

Environmental & social: FSC chain‑of‑custody, amfori BSCI, other audits (e.g., SEDEX, SA8000)Management Systems World+8ISO+8ISO+8

Not every good supplier will have all of these, but the more demanding your customers are (especially in Europe/North America), the more these credentials matter.

Step 5 – Evaluate MOQ, Lead Time and Capacity

Ask up‑front:

MOQ for: stock designs, semi‑custom, and fully custom prints

Standard lead times for:

Sample

Mass production

Peak season (e.g., Christmas)

Monthly capacity (rolls/sheets) and how they handle overlapping orders

Step 6 – Request Samples & Run Test Orders

A typical flow:

Send your artwork and specs.

Receive digital proof + physical sample (plain stock or actual design).

Approve or adjust colors and finishes.

Place a small test order before your big launch.

Use the test order to stress‑test:

Paper strength (tear resistance)

Print scratch resistance

Color consistency across cartons

Step 7 – Negotiate Pricing, Terms and Long‑Term Cooperation

For serious long‑term programs:

Discuss yearly volume forecasts rather than one‑off volumes.

Clarify payment terms (TT, LC, deposit structure).

Agree on price review points (e.g., annual, or when paper prices move beyond a given index).

Top 10 Wrapping Paper Manufacturers in China (Detailed Profiles)

These profiles are based on each company’s public information (websites, official profiles, B2B listings). Always reconfirm details and certifications directly with the factory.

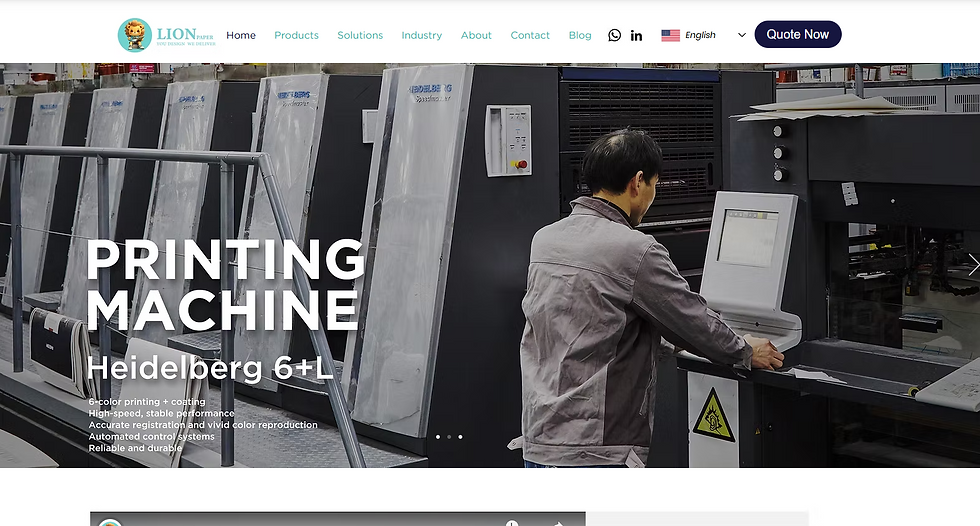

Company Snapshot

Lion Paper Products started in Jiaxing, in 2015, focused on exporting paper products, lifestyle items, and stationery. Over time, it built its own paper product factories in Cambodia, supporting a one‑stop paper gift and stationery solution for global customers.

Core Strengths

Wide catalog: gift wrap, gift bags, lifestyle items, stationery, and holiday times items.

Multi‑country factory footprint that helps optimize tariffs and lead times

Experience working with major retailers and brand owners in the US, UK, EU...

Best For

Large and mid‑size retailers

Brands looking to bundle wrapping paper + gift bags under one supplier

Suggested Buying Process

Share your seasonal line‑up (Christmas, birthdays, party themes).

Shortlist designs from Lion Paper’s catalog or request OEM/ODM concepts.

Approve samples and packaging.

Lock in a production and shipping calendar before peak season.

2. TN Wrap Paper

Public, verifiable information on TN Wrap Paper is limited compared with the larger brands above. It appears mainly in B2B directories rather than having a prominent standalone site.

How to Work Safely with Such Suppliers

Treat them like factory‑trading hybrids: ask directly whether they own the production line or subcontract.

Request factory photos, certifications, and video calls.

Start with a small, non‑critical order and consider using third‑party inspection firms such as SGS, Bureau Veritas, or Intertek for higher‑risk projects.

This kind of supplier can be useful where price is decisive and your internal team has solid sourcing experience.

3. PackingOne

PackingOne positions itself as a wrapping paper and paper packaging factory focused on printed gift wrap and related paper goods. It emphasizes printed and premium wrapping paper, including eco Christmas wrap and custom designs through its featured products.

Core Strengths

Strong focus on printed gift wrapping paper

Offers premium and eco‑focused ranges via multiple product pages

Used to customizing designs and sizes for international clients

Best For

Importers who want a large mix of patterns and SKUs

Distributors consolidating gift wrap programs across different markets

4. Best 4U

Best 4U is known mainly from trade directories and B2B listings, typically presented as a supplier of gift wrap, gift boxes, and paper packaging.

Core Strengths

Flexible in private‑label and OEM projects

Good match for buyers who want bundled sets (e.g., box + wrap + tags)

Generally works with small to mid‑size order volumes

Because primary data is limited, treat Best 4U similarly to TN Wrap Paper: verify on‑site capacity and compliance before placing big orders.

5. Xiamen Blue City Print Co., Ltd.

Company Snapshot

Founded in 1995, Xiamen Blue City Print focuses on scrapbook & paper crafts, including scrapbook paper, pads, stickers, craft cards, and wrapping papers. It highlights ISO and G7‑related print management and long export experience.

Core Strengths

Nearly 30 years of experience in paper printing

G7‑aligned color control for consistent output across runs and substrates

Strong fit for pattern‑heavy wrapping paper and coordinated paper sets

Best For

Stationery brands

Scrapbooking and craft retailers

Gift wrap collections where color‑matching is critical

6. JUDI Packaging (Dongguan Judi Industrial Co., Ltd.)

Company Snapshot

JUDI describes itself as a leading innovator in eco‑friendly paper packaging, combining design, production, and distribution for global brands. It offers everything from tissue paper and gift wrapping paper to paper bags and rigid boxes.

Core Strengths

Strong sustainability positioning: recycled stocks, eco‑friendly coatings, and premium paper choices

Full service: design → sampling → mass production → delivery coordination

Ability to customize structures, unboxing experiences, and print effects

Best For

Fashion, lifestyle, and cosmetic brands

DTC brands wanting coherent branded packaging across touchpoints

7. Jialan Packaging Products (Yiwu Jialan Package Co., Ltd.)

Company Snapshot

Based in Yiwu, Jialan focuses on gift paper bags, packaging boxes, wrapping paper, and notebooks. It combines custom printing with large‑scale production and is widely present on B2B platforms.

Core Strengths

Located in Yiwu, one of the world’s largest wholesale hubs for gift packaging

Wide assortment of gift bags + boxes + wrap, ideal for cohesive programs

Flexible MOQs for custom printed wrapping paper

Best For

Small and mid‑sized retailers

Amazon/e‑commerce sellers who need manageable MOQs but factory‑level pricing

8. MyStyle Ribbon (Xiamen Meisida Decoration Co., Ltd.)

Company Snapshot

MyStyle Ribbon (Xiamen Meisida) specializes in ribbons, bows, and decorative accessories and also produces wrapping paper and paper crafts. Company info describes two factories producing woven/wired ribbons, wrapping paper, paper tags, and boxes for export to Japan, Europe, and the US.

It also highlights eco‑friendly paper ribbon options and references FSC‑related certification in its news section.

Core Strengths

Ribbon + gift wrap in one place, ideal for coordinated collections

Seasonal ribbon and wrap sets for Christmas, weddings, and events

Experience with international buyers and stricter material requirements

Best For

Brands and retailers who sell both ribbons and wrapping paper

Seasonal decoration ranges (Christmas, wedding, Valentine’s Day)

9. Mikirei

Company Snapshot

Mikirei positions itself as a stationery and gift‑packing manufacturer producing gift bags, gift boxes, greeting cards, wrapping paper, party accessories, notebooks, pens, and school bags. It emphasizes original design and notes that its collections are sold in more than 100–120+ countries worldwide.

Core Strengths

Very strong design pipeline (thousands of new designs annually)

Broad product range to build full gift and stationery lines

Deep export experience, including branded projects

Best For

Chains and brands that want trend‑driven, illustrative gift wraps

Retailers who need matching gift bags, boxes, and cards alongside wrapping paper

10. Xincan Packaging Products (Yiwu Xincan Packaging Products Co., Ltd.)

Company Snapshot

Founded in 2018 in Yiwu, Xincan Packaging Products focuses on wrapping paper, gift boxes, packaging boxes, stickers, Christmas accessories, window stickers, and other holiday products.

Core Strengths

Strong holiday and seasonal focus (Christmas, festive assortments)

One‑stop sourcing for wrapping paper + matching seasonal decor

Located in Yiwu, making mixed‑container sourcing easier

Best For

Seasonal importers

Gift and decor brands building holiday collections in one place

Pricing, MOQ and Lead Time Benchmarks in China

Exact numbers change with paper prices, ink costs, and shipping, but you can think in relative tiers.

Typical Price Levels by Material (Qualitative)

Material / Type | Relative Cost Level* | Notes |

Plain brown kraft wrap | $ | Lowest cost, good for rustic & eco looks |

White woodfree / art paper | $$ | Standard gift wrap for retail and e‑commerce |

Metallic / foil paper | $$$ | Higher cost due to foil and extra processes |

Heavy textured papers | $$$ | Premium, often used for luxury brands |

Specialty eco papers | $$–$$$ | Recycled or FSC‑certified stocks can cost more, but support sustainability claims |

*Relative only; always request up‑to‑date quotes.

MOQ Ranges (Common Patterns)

Stock designs: as low as a few hundred rolls or packs per design.

Semi‑custom (your logo on existing patterns): MOQs often 1,000–3,000 rolls or packs.

Fully custom (unique design, special finishes): MOQs can start from 3,000–10,000 units, depending on print method and width.

Average Production & Shipping Timelines

A typical timeline for custom wrapping paper:

Artwork confirmation: 3–7 days

Sample production: 7–14 days

Mass production: 20–35 days (longer in peak season, e.g., pre‑Christmas)

Ocean shipping:

Asia → US/EU: ~25–40 days, plus customs and inland transport

Plan backwards from your in‑store date, not from when you “feel ready”.

Importing Wrapping Paper from China: Full Process

Step 1 – Shortlist Suppliers & Send RFQs

Use this top‑10 list plus major B2B platforms and trade shows.

Prepare a clear RFQ (artwork, sizes, quantities, packaging, target price, delivery port).

Step 2 – Confirm Specifications and Incoterms

The Incoterms® rules, published by the International Chamber of Commerce (ICC), are the global standard that defines who is responsible for costs, risks, and tasks at each point of the shipment.

For wrapping paper, common choices include:

FOB (Free on Board) – supplier handles export and loading; you handle freight and insurance.

CIF/CFR – supplier books the main sea freight; you handle insurance (CFR) or accept supplier’s insurance (CIF).

DDP – supplier delivers to your door including duties (good for small brands but needs a very trusted partner).

Step 3 – Sample Orders & Quality Checks

Ask for printed samples on the exact material and GSM.

Verify colors, opacity, and finish.

Use this phase to fine‑tune packaging (roll vs sheet, retail label, barcodes).

Step 4 – Contract, Deposit and Production

Sign a purchase contract with clear specs, delivery dates, payment terms, and defect/claim clauses.

Pay the agreed deposit (commonly 30%).

Step 5 – Pre‑Shipment Inspection and Documents

Before shipment, consider:

Pre‑shipment inspection via third‑party QC company (especially for first orders).

Confirm all shipping documents (invoice, packing list, bill of lading, certificates if needed).

Step 6 – Shipping, Customs and Final Delivery

Your freight forwarder or logistics partner will help clear customs. For complex trade terms, ICC’s Incoterms® guidance can reduce misunderstandings and hidden costs.

Quality Control Checklist for Wrapping Paper Orders

Use this checklist (or turn it into your internal SOP).

Paper Grammage, Opacity and Strength

Randomly weigh sheets/rolls to confirm GSM

Perform simple tear tests and “crumple tests”

Check show‑through on light papers

Color, Print Alignment and Surface Finish

Compare samples to approved color proofs under neutral light

Inspect registration (no visible misalignment of colors)

Check coating and foil for scratches, pinholes, or flaking

Eco & Safety Considerations

For kids’ products or food‑adjacent uses, confirm ink and coating safety (e.g., statements compliant with relevant food‑contact or toy regulations if applicable).

Ask for documentation on recycled content or FSC‑certified sources if you plan to market eco claims. Forest Stewardship Council

Packaging, Labeling and Barcodes

Confirm retail labels, barcodes, and warnings (if any)

Check outer cartons: strength, markings, palletization pattern

Verify that carton labels match your SKU system to avoid warehouse chaos

Conclusion: How to Pick the Best Partner from the Top 10 Wrapping Paper Manufacturers in China

If you’ve read this far, you’re already ahead of most buyers who just grab the cheapest quote.

To recap:

The gift wrapping paper and products market is a fast‑growing niche within a huge global packaging industry.

China is still the primary production base for many brands, thanks to strong printing capabilities, flexible customization, and export experience.

Your best match inside the Top 10 Wrapping Paper Manufacturers in China depends on your volume, design needs, and certification requirements.

Don’t skip the basics: clear specs, verified certifications (especially FSC, ISO 9001, BSCI), written contracts, and at least one third‑party inspection when you start.

Do this right once, and you’ll build a long‑term supply base that feeds your current site.

FAQs:

Q1: What is a typical MOQ for custom wrapping paper in China?

A: For fully custom designs, MOQs often start from 3,000–10,000 rolls or packs per design, depending on width, GSM, and printing method. Simpler or stock‑based options can go much lower. Always ask each supplier to break down MOQs by material and finish.

Q2: How long do production and shipping usually take?

A: A realistic timeline is:

Samples: 2–4 weeks

Mass production: 3–6 weeks

Ocean shipping: 4–6 weeks, depending on route

Build in a buffer of at least 2–3 weeks, especially before major holidays (Christmas, Lunar New Year).

Q3: Which certifications should I look for in a wrapping paper manufacturer?

A: At minimum, check for:

ISO 9001 (quality management)ISO+1

FSC chain‑of‑custody for sustainable paper sourcinganz.fsc.org+3Forest Stewardship Council+3anz.fsc.org+3

amfori BSCI or similar audits for labor and social complianceamfori+2Eurofins+2

Not every project needs all three, but they’re a strong signal of professionalism.

Q4: Is it better to work directly with a factory or through a trading company?

A:

Direct factory: better control, often lower long‑term cost, more complex communication.

Trading company / hybrid: easier communication, broader product range, but you must ensure they work with reliable audited factories.

Some companies (like Lion Paper Products or Mikirei) effectively combine both roles: they own key factories but also source around them.

Q5: How can small brands reduce risk on their first order?

A: Start with one or two main suppliers.

Keep your first order to one season or a limited range, not your whole catalog.

Use pre‑shipment inspection for the first 1–3 orders.

Stick to proven materials and finishes before experimenting.

Q6: How can I protect my custom designs from being copied?

A: No system is perfect, but you can:

Work with suppliers that have long‑term relationships with big brands and clear IP policies.

Register your trademarks and key designs in your main markets and, if possible, in China.

Limit access to full artwork files and use non‑disclosure clauses in contracts.

Monitor major marketplaces for obvious infringements and respond quickly.

For higher‑value designs, consider consulting a specialized IP lawyer who understands China + cross‑border e‑commerce.

Reference

Global gift wrapping paper & products market – Global Info Research; Market.us; Grand View Research; Verified Market Research (2023–2024 market and forecast data for gift wrapping paper and gift wrapping products).Verified Market Research+3Global Info Research+3Market.us+3

Global paper & paperboard packaging market – Mordor Intelligence; Towards Packaging; GlobeNewswire reports on global paper & paperboard packaging size and CAGR.Zion Market Research+3Towards Packaging+3GlobeNewswire+3

FSC and sustainable paper/packaging – Forest Stewardship Council resources on paper, packaging, and FSC certification/labels.Forest Stewardship Council Canada+6Forest Stewardship Council+6anz.fsc.org+6

amfori BSCI social compliance – amfori and major audit providers explaining the BSCI system and its role in improving working conditions.Management Systems World+3amfori+3cps.bureauveritas.com+3

ISO 9001 and quality management – ISO resources describing ISO 9001 and the ISO 9000 family as the world’s leading quality management standards.ISO+3ISO+3ISO+3

G7 color management in printing – Idealliance and industry explanations of the G7 methodology and its importance for consistent color in printing and packaging.xrite.com+4connect.idealliance.org+4Idealliance+4

Incoterms® rules – ICC and ICC Academy explanations of Incoterms® 2010 and 2020 and their use in international trade contracts.ICC - International Chamber of Commerce+4ICC - International Chamber of Commerce+4ICC - International Chamber of Commerce+4

Are you looking for a reliable manufacturer? Reach out to Lion Paper for a free quote and consultation. Let’s collaborate on creating custom writing paper products that will set your brand apart from the competition!

Company Name: Lion Paper Products

Office Address: 20th floor, Chuangyedasha Building, No. 135, Jinsui Road, Jiaxing City, Zhejiang Province, China

Factory Address: No.135, Xuri Road, Jiaxing City, Zhejiang, China

Email: Leoxia@lion-paper.com

Audit Certifications: ISO9001:2015/FSC/SEDEX SMETA/Disney FAMA/GSV/SQP

Comments