Best Cosmetic Bag Suppliers in China 2026

- Leo Xia

- Nov 20, 2025

- 15 min read

Updated: Dec 28, 2025

Read keypoints from of this blog from Youtube:

If you’re searching for the best cosmetic bag suppliers in China in 2026, the shortlist is surprisingly clear. The most reliable partners in buyer portfolios are RIVTA, Wenzhou Classic Packing, Lucky Case, Kinmart, and Lion Paper Products.

Each covers a different niche: premium sustainable cosmetic bags, high-volume PVC and nylon, low-MOQ train cases, promotional and gifting bags, and one-stop multi-category suppliers for beauty + stationery. Together, they give you solid coverage whether you’re buying for a US drugstore chain, an EU supermarket, or an Amazon-first indie brand.

Quick Content Reach:

Executive Summary – Key Takeaways

Global demand is growing steadily. The global makeup/cosmetic bag market is growing at roughly 5–8% CAGR through 2030, driven by beauty growth, travel, and a shift toward multifunctional, sustainable bags. Deep Market Insights

China remains the core manufacturing hub. China controls roughly 40–50% of global luggage/bag production capacity, supported by integrated hubs in Guangdong, Zhejiang, and Fujian that specialize in bags, luggage, and accessories. Guoyanbag

The best cosmetic bag suppliers in China 2026 occupy clearly different positions:

RIVTA (Shenzhen/Dongguan) – eco‑luxury, GRS/ISO/BSCI/SEDEX, strong in recycled & vegan materials. ecorivta

Wenzhou Classic Packing (Wenzhou) – massive wholesale cosmetic bag programs, Disney FAMA, Walmart/Target audits, great for PVC/TPU and seasonal lines.

Lucky Case (Guangzhou) – low‑MOQ train cases and hard/soft pro makeup cases, strong OEM designs & FBA services. China Lucky Case

Kinmart (Quanzhou/Fujian) – promotional and custom cosmetic bags/toiletry bags for retail and GWP projects, with BSCI/Sedex/ISO9001 certifications highlighted by third‑party industry profiles. Kinmart

Lion Paper Products (China + Cambodia + Korea) – multi‑category sourcing (notebooks, stationery, lifestyle goods and cosmetic/storage bags) with strong packaging and gifting integration for retailers. Lionpaper-istyle

Certifications matter. For US/EU retailers, BSCI, SMETA/SEDEX, ISO9001, GRS, FSC, and Disney FAMA (for licensed programs) significantly reduce compliance risk. Sphere Resources

The “right” factory depends on your positioning (mass vs premium), MOQ, sustainability requirements, and whether you also need notebooks, packaging, and gifting sets in the same supply chain.

Overview – Why Source Cosmetic Bags from China?

Global Demand for Cosmetic and Makeup Bags

Cosmetic and makeup bags quietly ride on the back of the wider beauty boom. Several recent market studies estimate the global makeup/cosmetic bags market at roughly USD 2.8–3.5 billion in 2024, with projections to USD 4.5–5.8 billion by 2030 and a CAGR between 5–8%. Deep Market Insights

Key drivers:

More cosmetics, more bags. Beauty and skincare exports reached over USD 74 billion in 2024, and as consumers own more products, they need better ways to store and travel with them. World's Top Exports

Travel + on‑the‑go lifestyles. Travel and commuting demand compact organizers and TSA‑friendly, transparent cosmetic bags. Recent travel cosmetic bag reports highlight strong demand for multi‑compartment, travel‑ready designs. Verified Market Reports

Sustainability and premiumization. Around 48% of buyers now say eco‑friendly materials influence their purchase decisions, and premium cosmetic bags are growing faster than low-end SKUs. Global Growth Insights

For buyers, this means cosmetic bags are no longer a throwaway accessory. They’re becoming an entry‑level branding tool—especially for beauty, lifestyle, and gifting programs.

Why China Dominates Cosmetic Bag Manufacturing

Even with rising competition from Vietnam and other ASEAN countries, China is still the center of gravity for cosmetic bag production. CHINA SOURCING AGENCY

1. Full supply chain

China’s bag/luggage industry controls about 40% of global production capacity and exported nearly USD 28 billion of luggage in 2023, with expectations to pass USD 30 billion by 2024. Guoyanbag

Hubs in Guangdong (Guangzhou, Shenzhen, Dongguan), Zhejiang (Wenzhou, Yiwu), Fujian (Quanzhou) and others combine materials, hardware, printing, packaging, and logistics in one ecosystem. Minissimi Leather

2. Cost advantage with automation

Despite rising wages, Chinese factories maintain competitiveness using domestic industrial robots and automation, now accounting for around half of global industrial robot installations. Financial Times

That automation is particularly visible in cutting, sewing lines, and packaging—exactly where cosmetic bags sit—keeping unit costs attractive for US/EU retail without sacrificing quality.

3. Mature OEM/ODM ecosystem

China’s OEM/ODM cosmetics and packaging ecosystem is now a global powerhouse, serving everyone from indie brands to top beauty conglomerates.

For cosmetic bags, this translates into ready-made style libraries (ODM) and full custom from concept to engineering (OEM), plus in‑house pattern making, structure design, and branding options. connectedsourcing.com

4. Wide material libraryFactories can source almost any cosmetic bag material inside these hubs:

PU & vegan leather: widely available, including recycled PU and newer plant-based leathers such as apple and cactus leather at advanced suppliers like RIVTA.

PVC, TPU, EVA, mesh: Classic Packing and similar factories run huge volumes in clear/translucent cosmetic bags, often with Disney FAMA and big-box audits already in place.RPET and recycled polyester: Recycled PET and polyester are mainstream in eco-focused factories; RIVTA alone notes 200K+ recycled cosmetic bags per month.

Canvas, cotton, cork, nylon, neoprene: Kinmart and Classic Packing show wide ranges of cotton, nylon, and specialty effects like quilted, holographic, or glitter finishes

Types of Cosmetic Bag Suppliers in China

In practice, most cosmetic bag suppliers in China fall into four buckets:

Premium / sustainable factories

Deep material R&D (recycled, vegan, plant-based), strong GRS/GRS‑style documentation, and often brand audits from global beauty companies. RIVTA is the obvious example in this segment.

Wholesale mass‑production factories

High capacity, strong price, many SKUs, comfortable with big-box retailer audits and strict AQL standards—Classic Packing embodies this model.

Low‑MOQ, startup‑friendly suppliers

Flexible MOQs (100–500 pcs), quick sampling, ready-to-brand train cases and vanity cases, plus FBA prep—this is where Lucky Case shines for Amazon and DTC brands.

Promotional and gifting suppliers

Focus on gift-with-purchase (GWP), corporate kits, and subscription-box-friendly designs, often integrated with other bag types; Kinmart is a classic example.

At-a-Glance Comparison of Top Chinese Cosmetic Bag Suppliers

Supplier | Main Hub | Positioning | Typical MOQ* | Key Strengths |

RIVTA | Shenzhen / Dongguan | Eco-luxury, sustainable OEM/ODM | 500+ pcs | GRS/BSCI/ISO, recycled & vegan materials |

Wenzhou Classic Packing | Wenzhou, Zhejiang | High-volume wholesale & retail | 500–1,000+ | Disney FAMA, Walmart/Target, PVC/PET & canvas |

Lucky Case | Guangzhou, Guangdong | Train cases, pro kits, low MOQ | 100–300+ | Hard/soft cases, FBA-friendly, fast sampling |

Kinmart | Quanzhou, Fujian | Promotional, toiletry & cosmetic bags | 600–1,000+ | Dept-store experience, broad materials |

Lion Paper Products | Jiaxing + Cambodia | Multi-category + gifting integration | 500–3,000+ | Stationery + bags + packaging one-stop |

*Typical MOQs are indicative and vary by design, material, and season (check directly with each factory).

1. RIVTA Culture Equipment Co., Ltd (Shenzhen/Dongguan, Guangdong)

1. Company Profile

Founded in 1990 in Dongguan, RIVTA has evolved into a specialized, eco‑responsible cosmetic bag manufacturer serving beauty and lifestyle brands worldwide.

Their focus is firmly on cosmetic bags, toiletry bags, travel organizers, and related sewn products, with a strong emphasis on sustainable materials such as rPET, recycled polyester, recycled cotton, organic cotton, cork, and vegan leathers. ecorivta

Key facts buyers care about:

30+ years of experience in cosmetic and accessory bags.

Certified to ISO9001, BSCI, SEDEX, with additional environmental and recycled-material certifications like GRS.

Publicly states 200K+ recycled cosmetic bags per month production capacity.

Has passed audits from global cosmetic companies including L’Oréal via Intertek, which is important for brands piggy‑backing on similar standards.

2. Custom Ability

RIVTA’s value is in materials + structure + compliance:

Full OEM/ODM: from concept boards to final packaging, including tech packs and structure engineering (double‑layer organizers, brush holders, removable trays).

Material depth: GRS‑certified rPET, recycled PU, organic cotton, bamboo and other plant fibers, cork, and multiple innovative vegan leathers.

Branding options: Pantone-matched color, screen/transfer printing, embossing, foil stamping, laser cut patterns, woven labels, and metal logos.

Packaging: paper sleeves, recycled card boxes, printed gift boxes and eco‑friendly packaging to support sustainability storytelling.

3. Advantages

Sustainability credentials stronger than most competitors (GRS, GOTS‑linked materials, ISO9001, BSCI, SEDEX).

Proven track record with international cosmetic groups (e.g., L’Oréal audits), which eases supplier approval for similar brands.

Large, stable capacity with a 200K+ monthly output in recycled cosmetic bags alone.

Strong internal R&D on new eco-materials and consumer storytelling (bamboo, recycled velvet, recycled leather, etc.).

4. Ideal For

Mid‑to‑high‑end beauty brands needing sustainable cosmetic bag suppliers in China with credible third‑party certifications.

Retailers who must hit ESG and recycled content targets while maintaining good aesthetics.

GWP campaigns where the cosmetic pouch itself is part of the sustainability message.

2. Wenzhou Classic Packing Co., Ltd (Wenzhou, Zhejiang)

1. Company Profile

Wenzhou Classic Packing was founded in 2007 and has grown into a large-scale manufacturer of cosmetic/makeup bags, glasses cases, shopping bags, and paper boxes, serving North America, Europe, and beyond. Classic Packing

They emphasize high-volume, trend-led cosmetic bags in PVC, TPU, nylon, cotton, and mixed materials. Their product data shows 5,000+ SKUs in cosmetic and makeup bags and related accessories.

On compliance:

Holds ISO9001, BSCI, SEDEX and Disney FAMA certifications across multiple SKUs.

FAQ and trade-show listings confirm audits from Walmart, Target, Walgreens, Disney and others, which is critical if you’re shipping to those retailers.

2. Custom Ability

Classic Packing is optimized for wholesale and private label:

Printing: silk screen, heat transfer, digital, sublimation printing across PVC, canvas, cotton, Tyvek, etc.

Visual effects: holographic films, glitter, metallic foil, quilted and padded constructions.

Branding: zipper pullers, woven labels, all-over printed linings, custom hangtags and display-ready packaging.

MOQs: many items listed at 500–1,000 pcs per design, which fits mid‑volume retailers and promotional programs.

3. Advantages

Deep compliance track record with major US/EU retailers (BSCI, SEDEX, ISO9001, Disney FAMA, big-box audits).

Very competitive pricing on clear PVC/TPU and nylon cosmetic bags, thanks to scale and material specialization.

A constant flow of new, trend-driven designs aimed at seasonal programs and promotions.

4. Ideal For

Buyers serving mass or mid‑market retail, drugstores, fashion chains, and supermarkets.

Brands needing fast, low-risk replenishment for core cosmetic bag SKUs.

Promotional agencies needing Disney‑compliant or big‑box‑approved factories.

3. Lucky Case (Guangzhou, Guangdong)

1. Company Profile

Guangzhou Lucky Case (and related Lucky Aluminum Case entities) is a specialized manufacturer of aluminum cases, cosmetic cases, rolling train cases, and PU/nylon makeup bags, with more than 16 years of design and manufacturing experience. China Lucky Case

Their catalog covers:

Aluminum cosmetic cases and travel trolleys with LED mirrors.

Nylon and PU rolling makeup cases and large-capacity train cases.

Soft makeup bags and vanity cases aimed at both professional artists and consumer markets.

Lucky Case is strongly export-oriented, with key markets in North America, Europe, and Oceania, and often highlights that its mission is to save buyers ~30% cost while providing full OEM design support.

2. Custom Ability

Low MOQs: Many rolling makeup cases list MOQs from 10–100 pcs, and soft bags from 100–300 pcs, making them unusually friendly to smaller brands.

OEM/ODM: a professional R&D team supports customized layouts, tray configurations, lighting, and colors.

FBA‑ready: Alibaba listings explicitly mention FBA forwarding services, design customization, and strong review scores (~97%+ positive)—exactly what Amazon brands need.

3. Advantages

One of the few cosmetic bag suppliers in China that offers both aluminum train cases and soft PU/nylon bags under one roof.

Very fast sampling and production lead times (15–30 days on many SKUs) thanks to modular case structures.

Tailored for professional and semi‑pro beauty users—salons, makeup artists, hairdressers—where function and durability matter.

4. Ideal For

Amazon, e‑commerce, and subscription-box brands needing low‑MOQ hard cases and impactful hero products.

Professional salon suppliers and distributors in US, EU, AU.

Brands that want a signature rolling case as part of a launch or collaboration.

4. Kinmart (Guangzhou/Quanzhou Area, Fujian/Guangdong)

1. Company Profile

Kinmart has been active since around 2000, positioning itself as one of China’s leading bag manufacturers and wholesalers, with a big focus on cosmetic bags, makeup bags, toiletry bags, handbags, totes, shopping bags, travel kits and backpacks. Kinmart

Third‑party profiles and Kinmart’s own materials show:

Focus on soft bags (cosmetic, toiletry, shopper, backpack, etc.).

Client base that includes department stores, chain stores, and global importers.

Recognition for BSCI, Sedex, and ISO9001 certifications in industry sourcing guides—helpful for mid‑tier brands with audit requirements. NicheSources

2. Custom Ability

Kinmart is ideal for promotional cosmetics and toiletry projects:

Wide material spread: PVC, nylon, canvas, RPET, neoprene, quilted fabrics, and more.

MOQ on many items starts at 600–1,000 pcs per color, with tiered pricing for larger runs—sweet spot for GWPs and retailer-branded promos.

Strong at foldable, roll‑up, and hanging toiletry bags with hooks and organizer pockets.

3. Advantages

Solid balance of price, quality, and compliance for promotional grade bags.

Broad catalog that allows you to reuse the same factory for cosmetic bags, tote bags, travel kits, and some backpacks.

Long export history and customs records showing shipments into the US and Europe—reassuring for volume buyers. ImportGenius

4. Ideal For

Beauty brands running gift-with-purchase or subscription box projects.

Retailers that need coordinated cosmetic + travel + tote sets for seasonal promos.

Importers seeking a stable, mid-tier cosmetic bag manufacturer in China with mainstream audits.

5. Lion Paper Products

Company Profile

Lion Paper Products, a B2B supplier with over 10 years of experience, specializes in customizable lifestyle products like Cosmetic bags for businesses and events. They offer cost-effective bulk solutions with custom printing and private labeling, ideal for corporate promotions and retail resale.

Lion Paper Products is best known as a custom stationery manufacturer with factories in Jiaxing (China), Cambodia, and a partner facility in South Korea. Lionpaper-istyle

We’ve built our reputation on high-quality writing products and lifestyle goods for retailers and brands in the US, UK, Germany, Spain, Australia, Qatar, South Africa and more—supported by certifications like FSC, ISO9001, BSCI, SMETA/SEDEX, Disney FAMA, and others for different product lines.

Alongside paper products, our portfolio includes storage bags, pouches, and lifestyle organizers, which naturally extends into cosmetic and toiletry bag programs—especially when buyers want coordinated stationery, packaging, and bags under one brand story.

Cosmetic Bag Manufacturing Capabilities

Leveraging our multi-factory supply chain (China + Cambodia + Korea), we can position cosmetic or toiletry bags where they best fit tariff, lead time, or compliance needs.

Capabilities include:

Materials: PU, vegan-style leathers, PVC, canvas, RPET-style fabrics aligned with our existing notebook cover and storage lines.

Branding: screen and transfer printing, embossing to match notebook covers, woven labels, and packaging aligned with your stationery graphics.

Bundling: cosmetic bags packed with notebooks, planners, stickers, or gift items in a single, retail-ready set—back‑to‑school, holiday, or lifestyle collections.

Flexible MOQs: we routinely handle small-batch, high-complexity projects as well as large seasonal programs for global retailers.

Advantages

Design + packaging integration: because we already engineer gift boxes, sleeves, belly bands, and displays, we can make the cosmetic bag part of a cohesive story (for example, matching prints across pouch, notebook, and box).

Multi-category sourcing: one project manager can coordinate notebooks, planners, cosmetic bags, storage items, and packaging across China and Cambodia, simplifying your vendor matrix.

Compliance + quality systems already proven in demanding stationery and packaging programs, including FSC and social audits.

Ideal For

Stationery + beauty + lifestyle crossover brands wanting full collections (planner + pouch + storage + gift box) in one go.

Retailers planning back‑to‑school, holiday, or lifestyle gifting sets where cosmetic pouches complement notebooks and desk accessories.

Buyers who prefer a one‑stop solution with strong project management and multi-country production options.

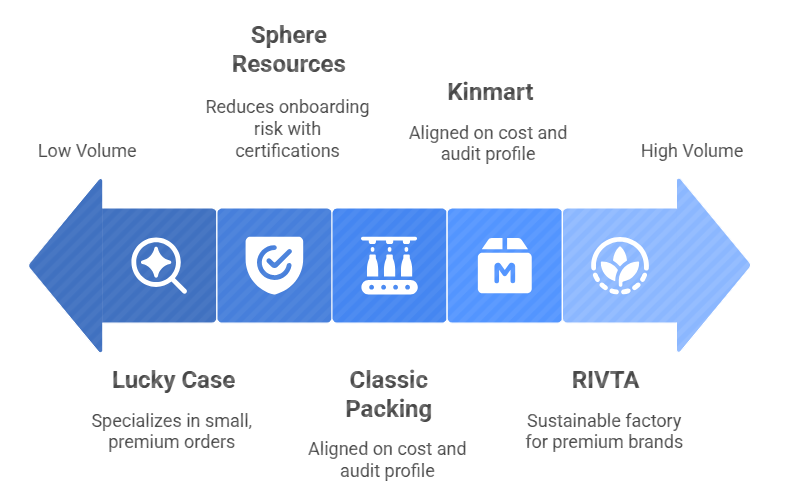

How to Select the Right Manufacturer

Positioning vs. reality

Premium eco brand? Start with RIVTA or a similar sustainable factory.

Mass‑market PVC/nylon? Classic Packing or Kinmart are more aligned on cost and audit profile.

Pro train cases or low‑MOQ hero SKUs? Lucky Case.

Certifications and social compliance

For US/EU chain retailers, factories with BSCI, SMETA/SEDEX, ISO9001 significantly reduce onboarding risk. Sphere Resources

For licensed programs (Disney, big-box US chains), look for Disney FAMA + retailer-specific audits like Walmart/Target.

MOQ and risk appetite

If you’re testing a new line, pushing a factory that normally runs 50,000 pcs/month down to 300 pcs will create friction.

Low‑MOQ specialists (Lucky Case) exist, but their unit cost will be higher—which is fine if you’re selling premium or online.

Material and sustainability needs

If you must meet GRS or recycled content targets, prioritize factories like RIVTA or others with transparent recycled-material programs.

For price-sensitive projects, PVC/TPU and polyester at Classic or Kinmart will win on landed cost.

Logistics & tariff strategy

Some buyers now split production between China and Cambodia/Vietnam to manage tariffs and duties. Lion Paper’s China + Cambodia + Korea setup is an example of this strategy in stationery and lifestyle goods.

Common Mistakes When Sourcing Cosmetic Bags from China (and How to Avoid Them)

1. Define Your Product Positioning

The biggest mistake I see is treating all cosmetic bag factories as interchangeable. A factory optimized for eco-luxury rPET cannot hit the same FOB as one focused on PVC promo bags, and vice versa. CHINA SOURCING AGENCY

Fix: write a one‑page positioning brief before you RFQ:

Target retail price & market (drugstore, Sephora‑style, online only).

Material band (PVC vs PU vs RPET vs organic cotton).

Expected certifications.

2. Check Certifications and Social Compliance

Skipping compliance is expensive later.

BSCI and SMETA/SEDEX are now baseline social audits for many US/EU retailers. Sedex

ISO9001 for quality systems, and GRS/FSC where recycled or paper components are key, are increasingly requested.

Ask for latest certificates and audit summaries, not just badges on a website.

3. Request Samples and Material Swatches

Ordering straight from a digital mockup is another common pitfall.

Cosmetic-bag buyers consistently report that texture, zipper quality, and lining weight are where cheap factories cut corners. Market reports also show rising consumer emphasis on durability and perceived quality. Global Growth Insights

Always request material swatches and at least 1–2 fully branded pre‑production samples before confirming mass production.

4. Verify Realistic MOQs and Price Structure

If a quote looks too good to be true, it usually is.

Some factories quote low and then up‑charge on trims, print positions, or packaging.

Others accept unrealistically low MOQs that disrupt their lines and eventually lead to delays or quality shortcuts.

Compare quotes across 3–4 cosmetic bag manufacturers in China and check if the BOM and packaging assumptions match.

5. Evaluate Communication and Project Management

Soft skills matter just as much as price:

Look for clear English communication, structured timelines, and proactive risk flags during sampling.

Bad communication correlates strongly with missed launch dates—something global bag/luggage sourcing guides call out repeatedly. CHINA SOURCING AGENCY

Factories like RIVTA, Classic Packing, and Lion Paper explicitly emphasize project management and QC transparency in their public materials.

6. Check Lead Time and Logistic Support

Finally, many buyers underestimate lead time + freight:

Typical custom cosmetic bag production in China runs 25–45 days after sample approval, plus 25–40 days for sea freight to the US/EU.

Some factories (Lucky Case, Kinmart) highlight fast-track or FBA‑oriented services, which can be decisive if you work with tight launch windows.

Ask early: “What’s your realistic lead time for this exact spec and this exact quantity?”—not just the generic number on a website.

Conclusion – Choosing the Right Chinese Manufacturer for Your

Cosmetic Bag Business

China will remain the core hub for cosmetic bags in 2026, thanks to scale, integrated supply chains, and mature OEM/ODM ecosystems.

RIVTA, Classic Packing, Lucky Case, Kinmart, and Lion Paper Products each occupy a distinct niche—from eco-luxury to mass-market wholesale, from low‑MOQ train cases to integrated stationery + cosmetic gifting.

The “best” cosmetic bag supplier in China for you depends on positioning, compliance, volume, and how many categories you want to manage with one partner.

If you’re a notebook, stationery, beauty, or lifestyle buyer and want to bundle cosmetic bags with planners, journals, or gift sets, you’re very welcome to contact me, Leo, at Leoxia@lion-paper.com or on WhatsApp +86 137 5075 6354. We can map out a sourcing plan that respects both your margin and your brand story.

—Leo Xia, CEO, Lion Paper Products

You design, we deliver.

FAQs:

Q1: Who are the best cosmetic bag suppliers in China in 2026?

A: Based on export records, certifications, and product focus, a practical shortlist is:

RIVTA – eco/sustainable premium cosmetic bags with GRS, ISO9001, BSCI, SEDEX.

Wenzhou Classic Packing – high‑volume PVC/nylon cosmetic bags with ISO9001, BSCI, SEDEX, Disney FAMA, and big-box audits.

Lucky Case – aluminum and soft train cases with low MOQs and FBA support.

Kinmart – soft cosmetic and toiletry bags for promotions, with long export experience and mainstream audits.

Lion Paper Products – multi-category stationery + lifestyle + cosmetic/storage bags, ideal for bundled collections.

Q2: What is a reasonable MOQ for cosmetic bag suppliers in China?

A: For mass-production factories (Classic, Kinmart), expect 500–1,000 pcs per design/color.

For premium sustainable factories (RIVTA), MOQs around 500 pcs are common due to material and setup costs.

For low‑MOQ specialists (Lucky Case), you’ll sometimes see 10–300 pcs on train cases and specialty items, at higher unit cost.

Q3: What certifications should I require from Chinese cosmetic bag factories?

A: At minimum for US/EU retailers:

Social compliance: BSCI or SMETA/SEDEX.

Quality system: ISO9001.

Material/environmental (if needed): GRS for recycled content, FSC for any paper packaging, plus specific tests like California Proposition 65 if you sell in the US.

Q4: Is it safer to buy from a trading company or directly from a factory?

A: Both can work, but:

Factories and suppliers (like RIVTA, Classic, Kinmart, Lucky Case, Lion Paper) usually give you better visibility on production and more control over materials and QA.

Trading companies can be helpful if your volumes per SKU are tiny or you need many factories consolidated, but they add a margin and can complicate communication. CHINA SOURCING AGENCY

For serious volumes and long-term brand building, I generally recommend working directly with audited factories and using experienced sourcing consultants only where they add real value.

Reference

- https://www.ecorivta.com/about/

- https://www.rivta-factory.com/

- https://rivta.en.alibaba.com/

- https://rivtabag.en.made-in-china.com/

Wenzhou Classic Packing (cosmetic bag manufacturer)

- https://www.classic-packing.com/

- https://classicpacking.en.made-in-china.com/

- https://classicpacking.en.alibaba.com/

- https://www.makeupbagwholesale.com/

- https://www.classic-packing.com/frequently-asked-questions

Lucky Case (cosmetic / train case manufacturer)

- https://chinaluckycase.en.made-in-china.com/

- https://cnluckycase.en.alibaba.com/

- https://www.tradewheel.com/co/guangzhou-lucky-case-8536/

- https://www.alucasefactory.com/

Kinmart (bag & cosmetic bag manufacturer)

- https://www.kinmart.com/

- https://kinmart.en.made-in-china.com/

- https://www.ecvv.com/company/kinmart/index.html

- https://www.startus.cc/company/huian-kinmart-handbags-co-ltd

- https://nichesources.com/wholesale-backpacks-china.html

Lion Paper Products (stationery & lifestyle manufacturer)

- https://www.lionpaper-istyle.com/

- https://www.lionpaper-istyle.com/about

- https://www.lionpaper-istyle.com/products

- https://www.lion-paper.com/

- https://www.lionpaper-istyle.com/solutions

Global market & manufacturing context

- https://deepmarketinsights.com/report/makeup-bags-market-research-report

- https://www.verifiedmarketreports.com/product/makeup-bags-market/

- https://www.globalgrowthinsights.com/market-reports/cosmetic-bag-market-119605

- https://www.guoyanbag.com/news/the-economic-overview-of-the-bag-industry-in-85147020.html

- https://www.minissimi.com/where-are-bags-manufactured-in-china-a-comprehensive-guide-to-key-hubs-sourcing-strategies/

- https://www.domatters.com/bag-manufacturers-in-china/

- https://www.towardspackaging.com/insights/cosmetic-packaging-market

- https://www.worldstopexports.com/beauty-cosmetics-and-skincare-exports-by-country/

- https://www.cognitivemarketresearch.com/makeup-bags-market-report

Compliance & social audits

- https://www.sedex.com/solutions/smeta-audit/

- https://www.qima.com/consumer-products/bsci-supplier-audits

- https://sphere-resources.com/comprehensive-guide-smeta-vs-bsci/

Are you looking for a reliable manufacturer? Reach out to Lion Paper for a free quote and consultation. Let’s collaborate on creating custom writing paper products that will set your brand apart from the competition!

About Lion Paper

Company Name: Lion Paper Products

Office Address: 20th floor, Chuangyedasha Building, No. 135, Jinsui Road, Jiaxing City, Zhejiang Province, China

Factory Address: No.135, Xuri Road, Jiaxing City, Zhejiang, China

Email: Leoxia@lion-paper.com

Audit Certifications: ISO9001:2015/FSC/SEDEX SMETA/Disney FAMA/GSV/SQP

Comments