2025 North America Back-to-school Stationery Market Trends: Key Insights

- Leo Xia

- Aug 8, 2025

- 4 min read

Updated: Aug 10, 2025

Quick Content Reach:

Introduction: Where Innovation Meets Emotion in Stationery

In 2025, the North American back-to-school stationery market is experiencing a profound transformation. The rise of AI, sustainable values, and social-media-driven purchasing behaviors are reshaping both product design and sourcing decisions. This article dives deep into market trends, actionable strategies, and buyer insights tailored specifically for stationery group buyers, wholesalers, and sourcing managers.

1. Consumer Trends: Tech-Empowered Tools Meet Emotional Value

Comparison of Back-to-School Consumer Behavior Data in the U.S., 2025

Indicator | K-12 Households | College Student Group | Parent Group |

Online Spending Share | 41.3% | 31.8% | 37.4% |

Early Purchasing (Completed by end of July) | 66% | 55% | 72% |

Acceptance of Premium for “Sense of Ceremony” Purchases | 35% | 48% | 28% |

1.1 AI-Powered Utility + Ceremony-Driven Consumption

According to the NRF 2025 Consumer Report, 45% of Gen Z in North America demand "paper-digital hybrid" products like smart notebooks that scan notes into Notion.

86% of global students use AI learning tools, with North America leading in AI-stationery integrations (e.g., voice transcription notebooks).

62% of parents are willing to pay more for ceremonial back-to-school items such as customized school-emblem notebooks.

The viral impact of TikTok is huge. Hashtags like #BackToSchool (58B+ views) and #DormAesthetic drive social buzz for items like "aesthetic notebooks" and DIY storage bags.

1.2 Rational vs. Emotional Decision-Making

89% of consumers rely on Google Shopping and TikTok trends for cost-performance comparison.

Brands now embrace transparency, highlighting cost-saving features like "30% less cost using recycled paper."

Emotional values still dominate. 55% of students see stationery as an expression of identity, fueling demand for limited artist collaborations and personalized laser-engraved notebooks.

2. Segmented Buyer Profiles & Purchasing Needs

Segment | Key Needs | Product Preferences | Sensitivity Factors | Share of Market |

Gen Z Students | Efficiency, social sharing | AR-interactive notebooks, erasable highlighters | Design trendiness | 32% |

Parents | Quality, price, sustainability | Durable folders, FSC-certified items, bulk bins | Price, certification | 59% |

Institutions | Compliance, volume, ESG | Anti-bacterial pens, modular storage, ESG items | ESG traceability, pricing | 9% |

3. Supply Chain Innovation: Nearshoring and Agile Production

Comparison of Stationery Production Costs and Logistics – China, Vietnam, and Mexico

Indicator | China | Vietnam | Mexico |

Labor Cost (USD/hour) | 3.2 | 2.5 | 3.8 |

Shipping Time to North America (days) | 30–40 | 25–35 | 3–7 |

Tariff Cost (Notebook) | 10% | 5% | 2% |

3.1 Nearshore Manufacturing Gains Momentum

USMCA advantages: 40% of Chinese stationery brands are assembling in Mexico to reduce notebook tariffs from 10% to 2%.

Transit times shrink from 30–40 days (China) to 3–7 days (Mexico).

Flexible logistics like rail-sea intermodal reduce total delivery times by 30%.

3.2 Agile Production

Small-batch MOQ now as low as 200 pieces—ideal for multi-SKU A/B testing.

AI-assisted scheduling enables 48-hour sample production, compared to traditional 7-day cycles.

4. Product Development for North American Markets

4.1 Functional + Emotional Value

Hybrid notebooks: Like smart notebooks that scan and auto-organize notes, now syncing with platforms like Quizlet.

Dorm-focused storage kits: Featuring USB cable organizers and foldable desktop stands.

Eco-Driven Design: FSC-certified notebooks with carbon offset labels command 15–20% price premiums.

Cultural Collaborations: Co-branded lines with IPs like Harry Potter evoke nostalgia among Gen Z.

5. Omnichannel Retail & Localized Engagement

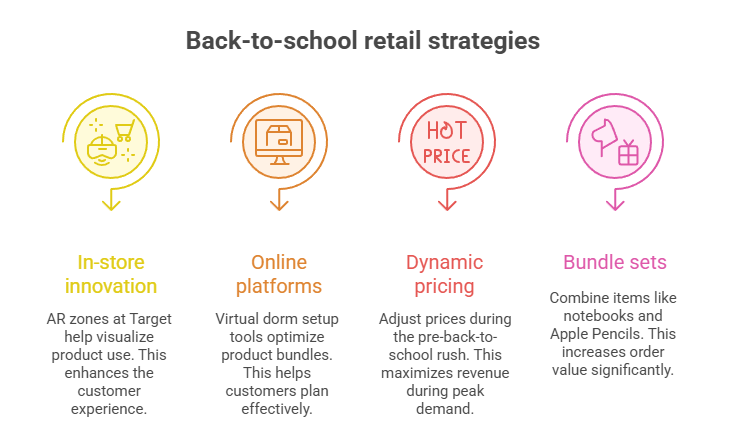

In-store innovations like AR Stationery Experience Zones at Target allow customers to visualize product use.

Online platforms offer virtual dorm setup tools for optimized product bundles.

Strategic promotions:

Dynamic pricing during the 3-week pre-back-to-school rush.

Bundle sets like "Notebook + Apple Pencil" increase order value by 18%.

6. Brand Strategy: Competing Through Experience and Values

6.1 Legacy Brands Go Digital

Staples launched Staples Connect, integrating AI tools to generate supply lists from class schedules.

Partnerships with apps like Notability allow cloud syncing and AI-powered summary features for smart notebooks.

6.2 Disruptor Brands on the Rise

EcoPens uses ocean-recycled plastics and donates $1 per item sold—social shares up 200% YoY.

StudyCube fosters user-driven designs via Discord—35% repeat purchase rate.

6.3 Risk Mitigation

Dual-capacity production in Mexico and Canada ensures 72-hour emergency restocking.

CCPA compliance is crucial for smart stationery to protect handwritten data.

7. Certification, Compliance, and Sustainability Strategy

Certification Type | Application | Premium Potential | Time to Certify |

FSC | Paper, wood | 15–20% | 3–6 months |

Cradle to Cradle | Mixed materials | 20–30% | 6–12 months |

Carbon Neutral | All categories | 10–15% | 1–3 months |

Over 60% of North American buyers recognize and trust FSC and Cradle to Cradle.

Promote via packaging and public carbon footprint traceability chains.

Conclusion: 2025 North America Back-to-school Stationery Market Trends

To succeed in the 2025 North American back-to-school market, suppliers and buyers must embrace:

Flexible, nearshore supply networks for faster turnaround.

Tech-integrated, sustainable, and expressive products.

Omnichannel touchpoints and immersive product experiences.

In the end, winners won’t just sell notebooks—they’ll help build ecosystems for learning, creativity, and emotional expression.

—Leo Xia, CEO, Lion Paper Products

You design, we deliver.

Are you looking for a reliable manufacturer? Reach out to Lion Paper for a free quote and consultation. Let’s collaborate on creating custom writing paper products that will set your brand apart from the competition!

Comments