Top 10 Notebook Manufacturers in China for Wholesale Buyers in 2025

- Leo Xia

- May 18, 2025

- 5 min read

Quick Content Reach:

If you’re sourcing notebooks for large‑volume programs in 2025, China is still the epicenter—but the field has narrowed to a handful of factories that combine capacity, compliance, and creative services. After walking production floors, reviewing audit files, and running test orders myself, here are the ten manufacturers I trust to keep shelves full and margins healthy next year.

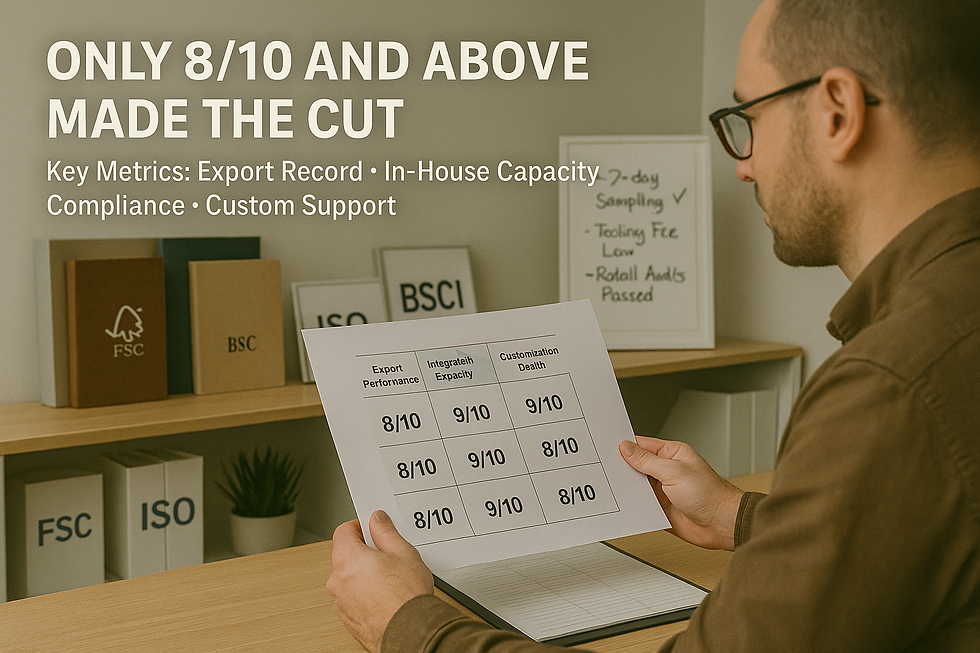

How I picked the list of notebook manufacturers

I looked at four data points:

Proven export performance—consistent U.S./EU shipments in 2023‑24.

Integrated capacity—in‑house printing, binding, and packaging that shortens lead times.

Compliance stack—ISO 9001 plus retail‑grade audits (BSCI, Sedex, Disney FAMA, FSC, CPSIA, Prop 65).

Customization depth—design support, low tooling fees, and fast sampling (≤ 7 days).

Only factories that scored 8/10 or higher on my internal matrix made the cut.

The 2025 Top‑10 Notebook Manufacturers in China

1. Lion Paper Products — (China&Cambodia)

My own plant tops the list because of the dual‑country set‑up (China + Current tariff‑free Cambodia+ Partner Factory in South Korea) and a proven 5 million‑unit annual capacity in China. Ten automated lines—Heidelberg printing, spiral binding, foil stamping—let us sample in 5‑7 days and ship bulk in as little as three weeks. Certifications include ISO 9001, Disney FAMA, CPSIA, Prop 65, and BSCI.

Why buyers care: flexible switch among China and Cambodia and South Korea sidesteps sudden tariff spikes while keeping SKU files under one roof.

2. Deli Group — Ninghai, Zhejiang

The stationery giant runs multiple notebook lines inside a 1‑million‑m² industrial park and supplies Wal‑Mart and Staples globally. Their “Nusign” loose‑leaf and soft‑cover books are backed by ISO, FSC, and an ESG program released in 2024.

Best use‑case: mass‑market SKUs where price‑per‑piece wins the bid.

3. M&G Stationery — Shanghai

M&G lists an astounding 7 billion‑piece annual capacity in its audited Made‑in‑China profile and publishes yearly ESG reports—rare transparency for a private Chinese firm.

Stand‑out edge: retail‑ready packaging studios that co‑engineer blister cards and gift sets in the same park.

4. Beifa Group — Ningbo

China’s pen champion is also a heavyweight in paper. Three industrial parks, 2,000+ staff, 3,000 patents, and full ISO9001/14001/45001 plus FSC and PEFC. A 2024 blog ranked Beifa among the six most influential stationery exporters.

When to use: private‑label gift combos (pen + notebook) that need one‑invoice kitting.

5. Guangbo Group Stock Co., Ltd. — Ningbo

With 4,500 employees and 10 subsidiaries, Guangbo ships to Office Depot, Staples, Wal‑Mart, and Carrefour. Their spiral, PU, and rubber‑cover notebooks pass U.S. and EU heavy‑metal tests by default.

Tip: leverage their in‑house plastic division for matching rulers and PP covers.

6. Syloon Stationery — Ningbo

Syloon’s 33,000 m² factory integrates offset printing, sewing, injection, and metal‑pen workshops, giving true “one‑stop” control and strong MOQ flexibility.

Sweet spot: fashion‑driven planners for teen or gift channels—Pantone hits are always on trend.

7. Interwell Stationery — Fuzhou

Operating since 2003, Interwell outputs 30,000 custom notebooks daily and carries Disney FAMA, BSCI, Sedex, FSC, and Wilko audits. Their R&D team throws in free cover layout tweaks—handy when you’re against a clock.

Ideal for: promo buyers who need fast design iterations without hefty art fees.

8. Sunnywell Printing — Shenzhen

A pure printing‑and‑binding specialist founded in 2015, Sunnywell runs 100+ staff and full Heidelberg lines. They offer Wire‑O, thread‑sewn, and perfect‑bound formats and can proof a fully printed dummy in 48 hours.

Pro move: pair Sunnywell with a Shenzhen gift‑box converter to land premium journal sets for under $3 landed.

9. Honeyoung Paper Printing Factory — Hefei, Anhui

50,000 m² facility, 300 workers, and two 5‑color Heidelberg presses. Monthly capacity tops 100 containers, with Disney, FSC, and ISO9001 files on record. Annual sales exceed $30 million.

Use‑case: exercise books or tender orders that live and die on container cost.

10. Labon Stationery (Wenzhou) — niche & eco

Known for stone‑paper and vegan‑leather covers, Labon offers low‑MOQ custom runs and Wire‑O books under $1.50 at 1 k pieces.

Best for: boutique brands chasing sustainability buzz without ballooning COGS.

Buyer tips for 2025

Audit the paper trail

Ask for FSC chain‑of‑custody numbers and test‑report validity (90‑day expiry on Prop 65).

Leverage multi‑country footprints

Lion Paper’s China‑Cambodia-South Korea switch and Deli’s Vietnam JV give tariff insulation. Mix PO release windows: 60 % China for Q2 back‑to‑school, 40 % Cambodia/Vietnam for holiday reps.

Don’t ignore lead‑time math

Even with China’s port congestion easing, inland trucking to Ningbo/Shanghai still adds 3‑5 days. Plants sitting within 100 km of a deep‑water port (Lion Paper, Deli, Syloon, Guangbo, Beifa, Interwell) shave freight by roughly $0.06 per A5 book west‑coast landed.

Sample aggressively

All ten factories will comp tooling on 10 k+ orders. Push for four‑up laser sheets first, then a single finished prototype—total cycle < 12 days at the right volume.

Final word

Choosing any supplier on this list will tick the big boxes—capacity, compliance, creativity—but the right fit depends on your program’s balance of price, speed, and brand story. If you need help lining up RFQs or splitting production across China, Cambodia and South Korea for your next project, feel free to contact us and let’s map the smartest route to your 2025 shelf.

—Leo Xia, CEO, Lion Paper Products

FAQs:

Q1: What are the typical minimum order quantities (MOQs)?

Most factories on my 2025 list start at 1,000–3,000 units. Lion Paper, Syloon and Labon will go as low as 1 k. Interwell, and Sunnywell prefer 2 k. For mass‑market programs, giants like Deli and M&G usually want 5 k or more.

Q2: How fast can I get a finished sample—and what will it cost?

Turnaround for a fully finished prototype is five to seven days. On orders above 10 k units the tooling or sample fee is waived or credited. If you’re racing a clock, my own Lion Paper sample room can push out a digital mock‑up in 48 hours.

Q3: Who can handle eco‑materials like stone paper or recycled leather?

Lion Paper, Labon and Syloon keep those substrates in stock. The others can source them, but allow an extra 7–10 days for the raw material pipeline.

Q4: Can I bundle notebooks with pens, mugs, or gift boxes?

Absolutely. Beifa and Guangbo excel at “pen + book” kits. Lion Paper and Sunnywell have preferred gift‑box converters to keep total cost down and clear everything under one customs entry.

Q5: Will these factories allow third‑party or video inspections?

Every supplier on the list does. Lion Paper and Interwell even use body‑cam video during QC so you can audit the inspection in real time. SGS, BV, and TÜV audits are welcome too.

Are you looking for a reliable manufacturer? Reach out to Lion Paper for a free quote and consultation. Let’s collaborate on creating custom writing paper products that will set your brand apart from the competition.

Comments